Chromatography Market Analysis:

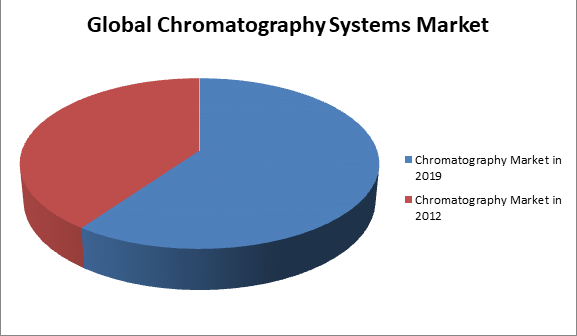

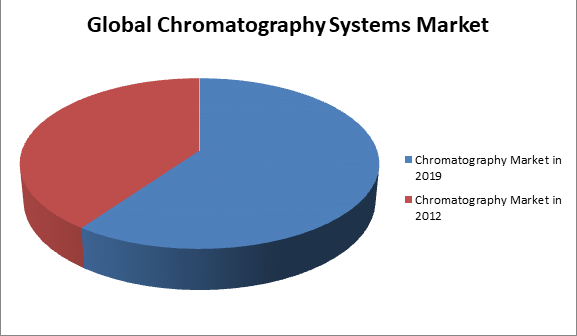

Chromatography is a laboratory technique which is majorly intended to separate compounds for purification or identification from a sample mixture. These systems comprise a group of techniques which is used for the separation of individual components from a sample mixture. Chromatography systems comprise of two phases namely, Stationary and Mobile phase. Mobile phase flows through the stationary phase where different migration rates of mobile phase components permit the separation of mixture of sample. The rapid increase in number of research activities in the field of pharmaceutical and biotechnology industries coupled with rising need of separation analysis globally due to the Increasing demand for chromatography systems. In addition, launching of new chromatography instruments, technological advancements and increasing awareness will further drive the growth and advancement of chromatography systems market. However, high cost involved in incorporation of automated features and designing will increase the growth of chromatography systems market. The global chromatography systems market is estimated to be USD 6,982.3 million in 2012 and is expected to reach USD 10,364.2 million by 2019, growing at a CAGR of 5.2% from 2013 to 2019.

Chromatography systems market is mainly segmented by types and end-users. Chromatography systems, by their types of segment are further classified as Liquid Chromatography, Gas Chromatography and other chromatographic techniques. Liquid chromatography is further segmented into High Pressure Liquid Chromatography (HPLC), Ultra High Pressure Liquid Chromatography (UHPLC) and Low Pressure Liquid Chromatography (LPLC). HPLC market is estimated to be the largest market of total liquid chromatography market when compared to all other techniques, expected to reach more than USD 3 billion by 2019. The growth is mainly attributed to advancement in technologies coupled with wide application areas of HPLC system in various disciplines (e.g. life science, petrochemical and biopharmaceutical). However, UHPLC market is considered to be highest growing from 2013 to 2019 at a highest CAGR of over 7%. Others segment is categorized into Affinity Chromatography, Column Chromatography , Ion Exchange Chromatography, Super Critical Fluid Chromatography and Thin Layer Chromatography.

The key players of the global chromatography systems market is highly fragmented with presence of a large number of marketing players that includes Agilent Technologies, Inc., Thermo Fisher Scientific, Affymetrix, GE Healthcare, Roche Diagnostics Limited, Waters Corporation, Shimadzu Corporation and others.

Mass Spectrometry Market Analysis:

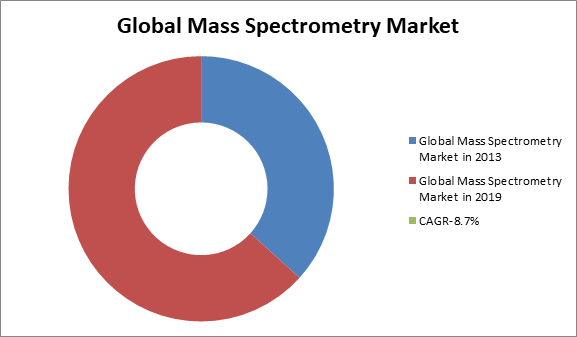

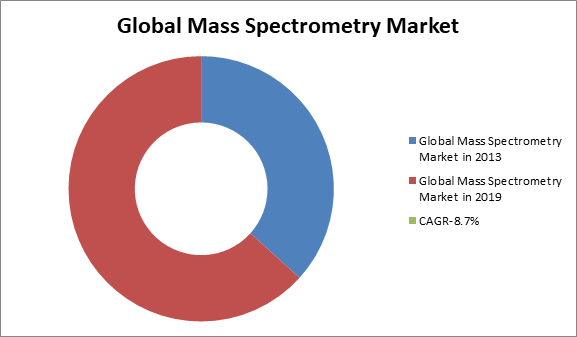

The global mass spectrometry market, mainly driven by technological advancements, increased pharmaceutical research, growing concern for food safety, and increase in investments, funds and grants by government bodies worldwide, was valued at $4017 million in 2013, and expected to reach $6096 million by 2019, at a CAGR of 8.7%.

The report ‘Global Mass Spectrometry Market forecast, 2012-2019’ analyzes the market by segments on the basis of technologies, such as tandem LC/MS, LC/MS-TOF, MALDI-TOF, single quadrupole, Fourier transform, and gas chromatography. The mass spectrometry market is predominantly driven by the tandem LC/MS technology, followed by gas chromatography, and LC/MS-TOF. With a market value of $1687.1 million and $602.6 million, tandem LC/MS and gas chromatography segments have been contributing 42% and 15% respectively to the total internal beam radiotherapy devices market.

The highest share of tandem LC/MS is attributed to the increasing awareness regarding preventive health and safety, leading to an increase in the list of regulated compounds and analytes, as well as the demand for high-throughput analysis pharmaceutical companies.

North America dominated the mass spectrometry market, followed by Europe and Asia. Europe is an established market for mass spectrometry, and is currently witnessing steady growth mainly due to the strict regulations for food and drug safety and the strong research base in the region. Germany commanded the largest share of the European mass spectrometry market.

The research-based pharmaceutical industry can play a critical role in restoring Europe to its growth post the economic slow-down and in ensuring future competitiveness in an advancing global economy. In 2012, it invested an estimated €30,000 million in R&D in Europe.

Research environment in emerging economies, such as Brazil, China, and India has led to a gradual migration of economic and research activities from Europe to these fast-growing markets. In 2012, the Brazilian and Chinese markets grew by 16% and 21% respectively, compared to an average market growth of minus 2% for the five major European markets and minus 1% for the US market.

The United States has the largest number of biotechnology firms with 6213 firms in the region, followed by France with 1359 firms, and Spain 1095 with firms. The 18 reporting countries from the European Union have a total of 5,398 firms.

According to World Health Organization, The global pharmaceuticals market is worth $300 billion a year, a figure that is expected to rise to $400 billion within three years. The 10 largest drugs companies in this sector have control over one-third of this market, several with the sales of more than $10 billion a year and profit margins of about 30%. Six are based in the United States and four in Europe. It is predicted that North and South America, Europe, and Japan will continue to account for a full 85% of the global pharmaceuticals market well into the 21st century.

The report also provides an extensive competitive landscaping of companies operating in this market. The major companies in this market are Agilent Technologies (U.S.), Bio-Rad Laboratories (U.S.), PerkinElmer (U.S.), Thermofisher Scientific (U.S.), Bruker (U.S), Rigaku (Japan), Waters Corporation (U.S), Danaher Corporation (U.S.), and Shimadzu Corporation (Japan).